New york–(Company Cable)–Kennedy Lewis Capital Government LLC (“Kennedy Lewis”), a number one alternative borrowing agency, in addition to Ca State Teachers’ Old-age System (CalSTRS), keeps established a strategic relationship focused on older corporate lending to own non-backed individuals.

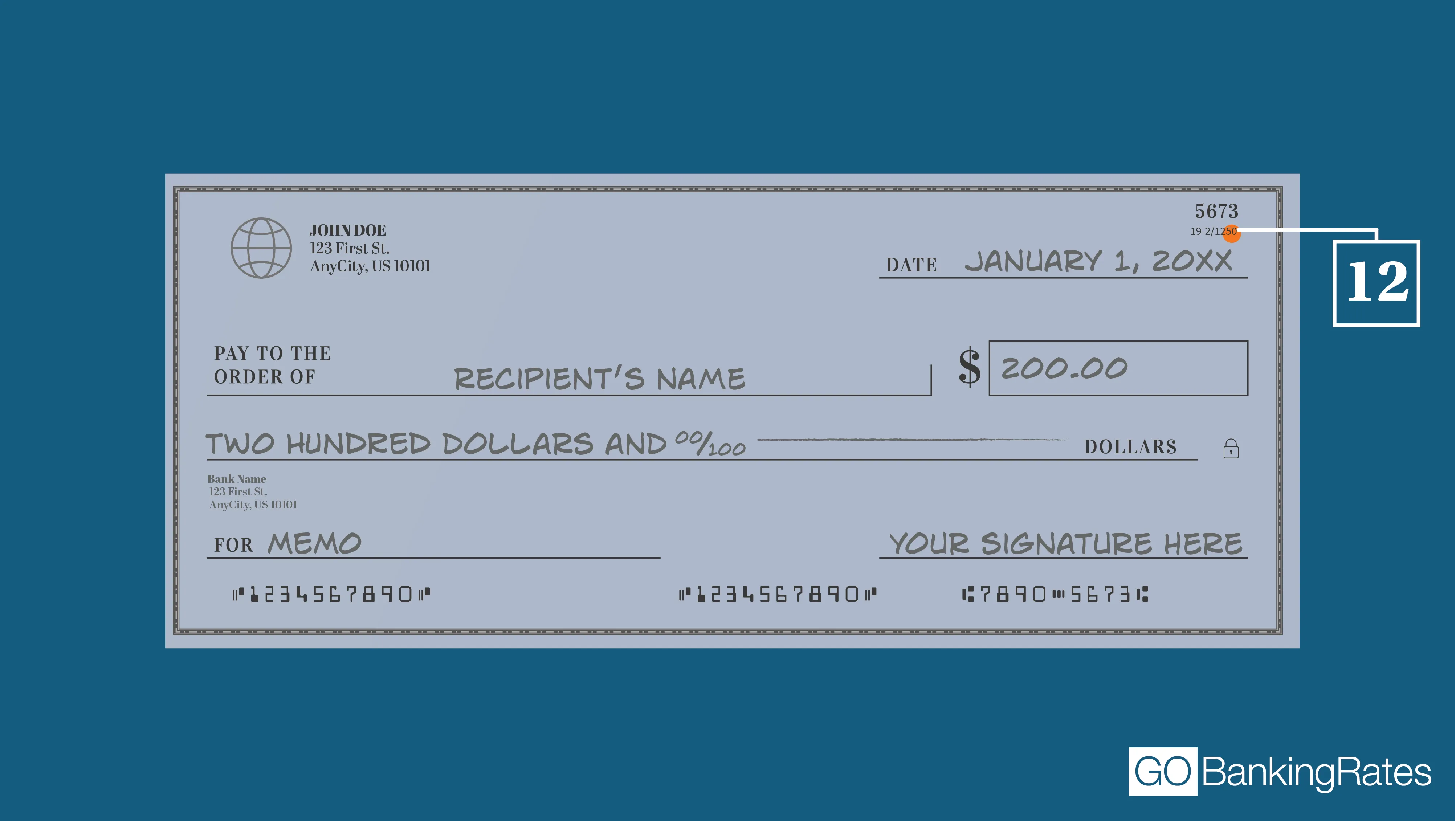

Together with assets when you look at the Kennedy Lewis’ core credit strategy, CalSTRS offers Kennedy Lewis that have $200 billion of seed financial support to support the growth out-of Kennedy Lewis’ Financial support Organization (KLCC), this new firm’s low-change traded, perpetual-existence Business Development Providers (BDC). Which partnership reflects CalSTRS and you can Kennedy Lewis’ common confidence about glamorous total go back and diversification professionals given by non-sponsored direct financing as well as appeal to a general directory of people.

“We’re very happy to lover that have CalSTRS, among earth’s leading organization dealers, noted for coming to the newest vanguard of the financing government world,” told you David K. Chene and you may Darren L. Richman, Co-Founders and you may Co-Dealing with Partners away from Kennedy Lewis. “There can be currently a very powerful opportunity set that is cost-free so you can mentor-supported financing mandates during the non-sponsored head lending space. We come across the possibility to attain diversity across areas and you may secure helpful terms and conditions and you may prices. We anticipate desire which money opportunity with respect to CalSTRS, its beneficiaries, and all of investors from inside the KLCC.

Richman having as much as $sixteen billion around management around the personal finance, a corporate creativity providers, and you may collateralized financing debt

Kennedy Lewis’ key credit means focuses primarily on originating and you may investing in senior-secure, floating speed, funds so you can center- and you may higher-middle sector non-paid people.

Kennedy Lewis are a choice borrowing manager mainly based from inside the 2017 because of the David K. Chene and Darren L. The business tries to deliver glamorous chance modified efficiency for clients because of the purchasing over the borrowing segments through its opportunistic credit, homebuilder funds, center credit and you will broadly syndicated financing tips.

CalSTRS provides a safe advancing years so you’re able to more one million professionals and you can beneficiaries whoever CalSTRS-secure provider is not eligible for Personal Shelter participation. On average, people just who resigned for the 202223 had 25 years off service and you will a monthly advantageous asset of $5,141. Established in 1913, CalSTRS ‘s the premier teacher-only retirement fund international having $337.nine billion inside assets lower than administration by . CalSTRS reveals the strong dedication to enough time-title durability standards within its annual Durability Declaration.

The strategy benefits from Kennedy Lewis exclusive sourcing streams round the a range of marketplaces and you will sectors where in fact the corporation keeps specialized expertise, and its particular protective funding method you to definitely emphasizes a lot of time-title borrowing abilities and dominating shelter

Particular pointers contained in this material constitutes forward-looking statements, and that’s recognized by the usage of forward-looking terminology particularly could possibly get, will, assume, intend, greet, imagine, faith, continue or other similar terms and conditions loans Mount Vernon AL, and/or downsides thereof. These could tend to be our very own financial forecasts and you may rates and their fundamental assumptions, statements about arrangements, objectives and you can traditional in terms of upcoming procedures, and you can comments regarding coming show. Such as submit?looking statements are inherently undecided and there is actually or may be techniques that could trigger real effects otherwise leads to disagree materially from those individuals conveyed this kind of comments. We think this type of activities are but they are not limited to people explained according to the part titled Risk Issues for the KLCC’s prospectus and you may such updated issues utilized in their occasional filings for the Ties and Change Percentage (the brand new SEC) in fact it is obtainable with the SEC’s web site from the . Such situations should not be construed while the thorough and should become see with the most other preventive comments that are included inside KLCC’s prospectus or other filings. But as the if you don’t required by federal bonds rules, we take on no responsibility so you’re able to in public revision otherwise revise one forward-looking statements, whether right down to this new advice, future advancements if not.

Brand new items in which question: (i) do not create an offer out-of bonds otherwise a good solicitation from a deal to purchase bonds out of KLCC and other device, (ii) even offers can be produced merely because of the KLCC’s prospectus which is available through to consult, (iii) dont and should not alter the KLCC prospectus that’s qualified with its totality from the prospectus, and you may (iv) is almost certainly not depended on to make an investment choice relevant to almost any resource. All-potential investors during the KLCC have to investigate prospectus with no person may invest without recognizing receipt and you may complete summary of new prospectus.