- Who The audience is

- Occurrences

- Blogs

- Board Webpage

- X (Twitter)

- Email address Register

After dreaming off homeownership, the next phase is making it an actuality, that’s confusing. Of a lot inquiries appear for those birth the procedure, such as for example simply how much do you have to set-out on a good household? What you should find out about to invest in property for the Tx? What is actually an effective First-Time Household Consumer? Where to find real estate aid in Tx?

Houston Environment to own Humanity will be here to help with your! Below try the basics of offered homeowner advance payment guidance software for the Tx.

Could you be a first-Go out Homebuyer?

When you’re, otherwise would like to getting, a good kick off point will be to find out if you be considered to have a primary-big date homebuyer program, mortgage otherwise advice. One or two major benefits associated with becoming a first-date homebuyer is the fact standards are generally much more versatile than old-fashioned programs, and lots of choices are available.

The common checklist rate having property inside the Houston is actually $334,000 inside . One to matter decrease step three.2% year-over-year, centered on real estate agent. On the current home values, making https://www.availableloan.net/installment-loans-ar/austin/ a down payment inside the Houston, Tx might cost $ten,020 to possess step three% down payment, otherwise $66,800 to have 20% down payment.

Applications & Offers having Texans

Colorado features its own homeownership recommendations software and you may grants customized especially in the event you phone call this new Lone Superstar county domestic.

? Houston Environment to have Humanity thanks to volunteer work, makes and you can rehabilitates households to possess group in need of assistance. Initiate right here to see who’s eligible to use! ? NACA will bring complete counseling and you will access to the Finest in The united states mortgages to own reasonable homeownership to have lower-to-reasonable earnings somebody. ? Colorado Agency out-of Homes and you will Society Facts programs assist average- and low-earnings family reach homeownership into the Tx thru a few software: My personal Earliest Colorado Household system as well as the My personal Choice Colorado Family loan.

Brand new Tx County Reasonable Homes Organization (TSAHC) are a beneficial nonprofit organization developed by the latest Colorado Legislature to simply help Texans go homeownership. The next phase is calling an area using lender and you may backlinks to possess trying to get a mortgage attention tax borrowing from the bank. Such DPA apps is downpayment recommendations Colorado grown!

A down payment is the money paid off initial to do good real estate purchases. Off money are usually a percentage out of a home’s price and can cover anything from 3% 20% having a priple, in the event that a property will set you back $100,000 and you can a down-payment of 5% will become necessary, following $5,000 should be reduced at the time of get.

Down-payment guidance (DPA) is actually a general identity to own financial help having homeowners. Such software reduce the amount would have to be stored having good home’s advance payment. Options available to possess DPAs were money to have cost with low or zero appeal, forgivable fund, and you may economic gift ideas which never have to be paid back.

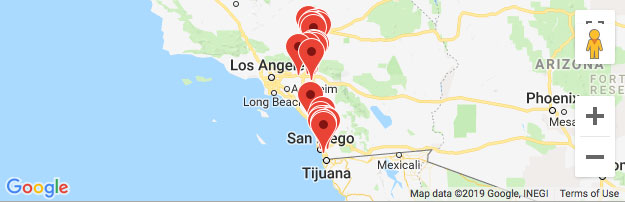

Houston Homebuyer Recommendations Programs

The metropolis out-of Houston Housing and Neighborhood Invention will bring a no-interest, forgivable loan (shielded by an excellent lien) as much as $fifty,000 to help you earnings-certified customers to have very first-big date homeowners when you look at the urban area limitations thanks to their Homebuyer Assistance System.

Official certification as satisfied are family earnings during the otherwise less than 80% of Town Average Money, first-time homebuyer (otherwise have not owned property in the last 36 months), You.S. resident otherwise long lasting citizen, together with domestic for purchase qualify to invest taxes so you’re able to the metropolis out-of Houston. The borrowed funds try met in the event your consumer stays in our home for 5 ages.

An alternative choice has been the fresh new Harris County People Properties Department’s off commission direction, hence facilitates home buyers lookin regarding unincorporated aspects of Harris Condition; so it help excludes home into the official places away from Houston, Baytown, or Pasadena. Qualifying requirements has a credit rating regarding 580 and you will effective end out of a keen 8-time homeownership studies movement.