- Addition

- Before we begin

- Ideas on how to code

- Investigation clean

- Research visualization

- Function technologies

- Design knowledge

- Completion

Introduction

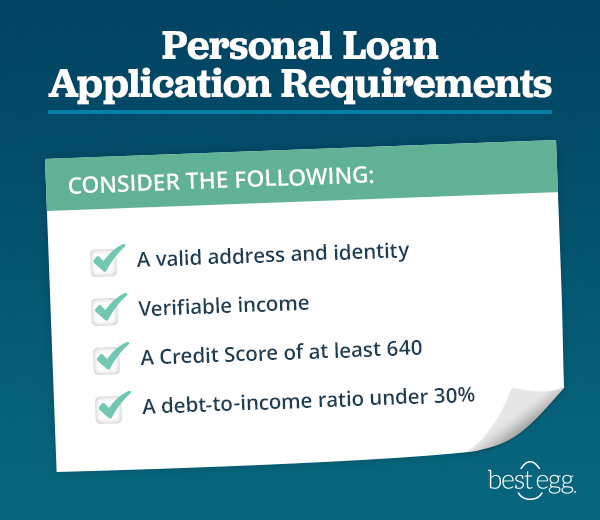

The brand new Dream Housing Financing business selling throughout home loans. He has got a visibility across all metropolitan, semi-metropolitan and you can rural elements. Owner’s here first make an application for home financing and providers validates the owner’s qualifications for a financial loan. The business desires automate the mortgage qualification procedure (real-time) centered on buyers facts provided while you are filling out on the internet applications. These records are Gender, ount, Credit_History and others. In order to automate the procedure, they have considering a challenge to spot the client locations one qualify to the loan amount and additionally they normally particularly target these customers.

Prior to we initiate

- Mathematical has actually: Applicant_Income, Coapplicant_Earnings, Loan_Number, Loan_Amount_Name and you can Dependents.

Tips password

The business commonly approve the loan to your applicants that have a a Credit_History and you will who is likely to be in a position to pay brand new money. Regarding, we are going to stream this https://paydayloanalabama.com/shorter/ new dataset Mortgage.csv during the good dataframe to show the initial four rows and look their shape to ensure i’ve adequate studies while making our very own model creation-able.

You’ll find 614 rows and you will 13 articles which is adequate analysis and work out a release-ready design. The newest enter in characteristics can be found in mathematical and categorical form to analyze the brand new features in order to predict the target variable Loan_Status”. Let’s understand the analytical guidance out of mathematical details by using the describe() setting.

Of the describe() setting we come across that there are some lost counts in the details LoanAmount, Loan_Amount_Term and you can Credit_History where total amount is 614 and we’ll need certainly to pre-processes the information and knowledge to deal with the new missing data.

Data Cleanup

Analysis cleanup try a process to determine and correct mistakes for the the dataset which can negatively impression our very own predictive model. We shall discover null opinions of every column because the a first step to data tidy up.

I observe that you can find 13 missing beliefs when you look at the Gender, 3 for the Married, 15 for the Dependents, 32 in the Self_Employed, 22 into the Loan_Amount, 14 in Loan_Amount_Term and you may 50 inside the Credit_History.

Brand new destroyed viewpoints of your own numerical and you can categorical has actually was shed randomly (MAR) i.elizabeth. the details is not missing in all this new findings however, only within sub-samples of the information and knowledge.

So the destroyed opinions of the mathematical has actually might be occupied that have mean while the categorical has with mode i.e. many appear to going on philosophy. I fool around with Pandas fillna() function getting imputing the fresh new lost beliefs because estimate out-of mean gives us this new main tendency without having any extreme philosophy and you can mode isnt impacted by significant viewpoints; also both offer neutral returns. For additional information on imputing data make reference to our guide to the estimating forgotten study.

Let us browse the null values once more so there are no destroyed thinking just like the it will direct us to completely wrong efficiency.

Studies Visualization

Categorical Study- Categorical information is a kind of research that is used so you’re able to classification suggestions with the same features and that is portrayed of the distinct branded teams such as for instance. gender, blood type, country affiliation. You can read the content to the categorical study to get more knowledge out-of datatypes.

Mathematical Study- Mathematical data conveys recommendations in the form of wide variety particularly. level, lbs, decades. When you are not familiar, delight comprehend posts into numerical studies.

Function Systems

To manufacture a unique feature named Total_Income we’ll include a couple of columns Coapplicant_Income and you may Applicant_Income as we believe that Coapplicant is the individual throughout the exact same members of the family to own a for example. lover, father etc. and screen the first five rows of your own Total_Income. For additional information on line manufacturing with standards make reference to all of our class including line with conditions.