Your way to homeownership is sometimes flat that have pressures, especially for first-date homeowners within the The state, where market and value from living is infamously pricey. Yet not, the united states Service off Agriculture (USDA) loan program shines once the an excellent beacon regarding a cure for of numerous. Built to offer outlying creativity making homeownership alot more accessible, the latest USDA financing now offers several benefits making it a knowledgeable first-date homebuyer system in the Hawaii. Including zero deposit conditions, competitive rates of interest, minimizing financial insurance fees than the traditional loans.

The new genesis regarding my The state money spent strategy first started towards USDA loan. I made use of the system to purchase my personal basic family inside the Makakilo having $210,000 just like the a bankrupt single dad that have 1 year old de- nevertheless the USDA financing desired us to keep which currency and employ it toward enhancements at home. I would book your house away a year later to own self-confident cash flow and you can 36 months after that, We marketed your house to have $376,000 and you can rolled my personal payouts toward a good cuatro-unit rental property using a 1031 Change. I would personally make use of the Their state 1031 Change again 2 yrs later to sell it property and you may roll it on a duplex inside the latest Diamond Head urban area worth $step one.5M now and you will gross book out of $8,000/mo — every off a no advance payment capital I experienced made years prior!

Qualification

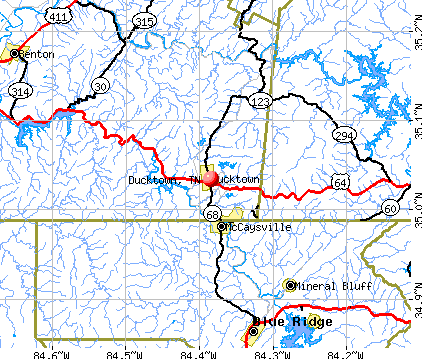

Qualification to have a USDA mortgage will be based upon multiple conditions, and additionally income, credit rating, additionally the location of the possessions. To meet the requirements, individuals need certainly to satisfy particular earnings limitations, which can be built to make sure the system suits people who truly need it. In addition, the home need to be located in a qualified outlying or residential district area, conveyed because of the white section throughout the map lower than. Though Hawaii is oftentimes in the their busy towns and cities and you will lavish resort, of many parts of the official qualify because the rural based on USDA criteria, making the loan just the thing for homeowners.

Eligible Communities for the Oahu

Ewa Beach – A quickly developing community towards the southwest shore off Oahu, recognized for their newer unmarried-nearest and dearest property, townhouses, and you can excellent tennis programmes. It offers a mixture of domestic comfort and you will convenience which have access to coastlines, shopping malls, and you may relaxation business.

Kapolei – Also known as “Oahu’s Next Area,” Kapolei try a king-arranged community which have a mix of home-based, industrial, and you may commercial elements. It has progressive features, colleges, shopping centers, and you may progressively more occupations, therefore it is a captivating spot to real time.

Regal Kunia – A typically agricultural area who has seen a transition to add much more home-based advancements. It is known for its silent, rural means in fact it is the home of brand new Kunia Nation Facilities, one of the greatest aquaponic facilities regarding condition.

Waikele – A suburban community noted for the well-structured home-based communities and prominent Waikele Superior Channels. It offers a blend of home-based managing comfort in order to looking and you can food alternatives, in addition to easy access to roads.

Waianae – Located on the west coastline out of Oahu, Waianae are a community which have a powerful Local Hawaiian populace, giving a more affordable housing market and you will astonishing charm, and additionally clean beaches and you can clickcashadvance.com wedding loans for bad credit walking trails.

North Coastline – Famous all over the world because of its searching shores such as for example Waimea Bay and you may Sundown Beach, brand new Northern Coast is a far more applied-back, outlying part of Oahu. Its known for its quick-city end up being, agricultural lands, and a tight-knit community worried about backyard living and you can maintenance of pure environment.

Kaneohe (northern of Haiku Highway) – An abundant, home-based town characterized by its good viewpoints of the Koolau Slopes and you may Kaneohe Bay. It has a combination of rural and you may suburban way of life, which have use of water items, organic home gardens, and you may walking trails. This particular area is known for its serenity and you may beauty, providing a serene function from the busyness from city lifetime.

Income Constraints

Earnings limits to own USDA finance into the Their state are prepared centered on the fresh new average income levels of the area additionally the size of your family. These restrictions is actually modified annually and therefore are designed to make sure that the newest loans are open to people and you can household having modest revenue. The latest dining table below stands for the fresh Honolulu State earnings constraints ranging from children of just one so you’re able to a family off 8. Be sure to source the conclusion “Mod. Inc-Guar Loan.”

Eg, a household out of five to get a house into the a specified outlying city for the Oahu might find that they must features a keen modified gross income that does not meet or exceed $150,650/yr.

Difficulties

Navigating the newest USDA loan processes will likely be easier than simply of numerous first-big date homebuyers you’ll predict, especially when compared to most other loan sizes. The secret to a softer software procedure try planning and working which have a loan provider proficient in USDA money. People need to have their financial files manageable, in addition to earnings verification, credit reports, or other relevant papers. Whilst program’s no downpayment requirements notably reduces the newest hindrance so you can homeownership, individuals still need to have indicated creditworthiness and also the capacity to pay off the loan.

Operating Go out

The fresh new running time for USDA loans can differ dependent on multiple facts, including the lender’s work, the fresh new completeness of your application, as well as the importance of most documentation. Normally, the procedure may take from around 45 so you can 60 days of application to help you closure. It’s important having applicants to get results closely and their financial and you will perform punctually in order to asks for pointers to prevent a lot of waits.

Having first-day homeowners in the The state, the new USDA financing program also provides an unequaled possibility to achieve homeownership within the most incredible towns and cities on earth. Having positives such as zero down-payment, quicker financial insurance policies, and you will aggressive rates of interest, it’s no surprise why way too many purchase the USDA mortgage as their gateway to homeownership. Of the knowing the qualification standards, earnings limits, and preparing for the application process, possible homebuyers normally browse the journey with full confidence, making the dream about home ownership for the The state possible.