So much more Videos

NORFOLK, Virtual assistant. – A separate declaration regarding VA’s Inspector General accuses elder authorities regarding Institution out of Pros Products out-of failing continually to include the brand new economic passion of handicapped experts just who used the agency’s prominent household financing guarantee program.

This is why, the fresh Agencies away from Experts Activities owes as much as 53,2 hundred experts an estimated $189 billion in home financing refunds, according to declaration.

TEGNA’s data revealed that older Va professionals inside Washington was indeed informed throughout the resource fee overcharges 5 years in the past from the officials regarding St. Paul, Minnesota Local Loan Cardiovascular system, however, didn’t capture corrective action.

OIG’s declaration claims, As incorrect investment fee fees just weren’t refunded, of several exempt experts may have sustained significant economic losings.

The brand new reimburse wide variety experts try owed usually are nice. An average money percentage costs is actually $4,483, to your premier topping-out within $19,470.

Roger’s Virtual assistant Financial

Roger Roath ordered his Lakeville, Minnesota house with the help of new VA’s generally praised Family Loan Make certain System. The history out-of as to the reasons they are due money is hidden within the their heap away from home loan suggestions.

Roger told you he’s had ringing within his ears since that time. Very in 2011, the guy applied for a handicap score toward Virtual assistant. Immediately after a primary assertion, he appealed. Their allege try ultimately approved, however it got big date.

Impairment waivers

![]()

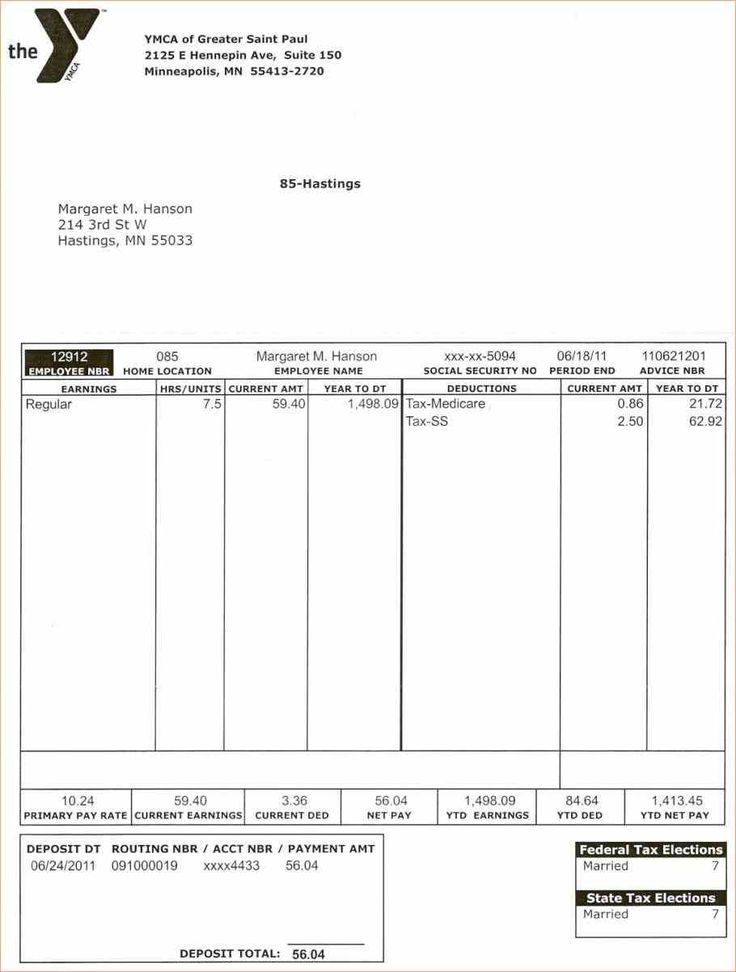

Experts whom make use of the Va program are usually expected to spend what’s called a “Investment Fee” — around step three.step three % of your amount borrowed. Within the Roger’s situation, that extra to several thousand dollars.

But the VA’s very own laws claim that in the event that a disability allege is eligible just after that loan are signed and the handicap score is established retroactive instance Roger’s was the fresh new veteran is born a refund of funding charges.

Regrettably, Roger says the guy failed to discover one up to the guy watched an investigative summary of KARE 11, TEGNA’s Minneapolis station, detailing an issue regarding the VA’s Home loan system.

Whistleblowers: experts were not informed

In may, a good whistleblower offered inner Virtual assistant suggestions you to definitely revealed an excellent bombshell. Disabled veterans along the state have been due home loan refunds weren’t usually having them, based on a diagnosis of funding fees over back in 2014 by team within VA’s St. Paul Regional Loan Center.

Several Virtual assistant insiders, speaking on the status away from privacy to guard their perform, said that high ranking authorities on Service out of Experts Activities headquarters inside Washington, D.C., was basically informed of your own procedure five years back.

Information show that Mike Frueh, following Movie director of your Va Financing Guaranty System, and you can Deputy Manager Jeffrey London were made aware during the 2014 one pros was being inappropriately energized and never offered refunds.

Frueh try after promoted https://paydayloancolorado.net/boone/ so you’re able to Captain regarding Teams to own Veterans Experts and Jeffrey London area got over off his dated manager and that is now Exec Director of the Mortgage Guarantee Solution.

The recently released OIG data confirms new professionals was actually informed about the a great debts due so you’re able to experts and you may did absolutely nothing to rectify the fresh overcharges.

The new OIG Analysis

Disturbingly, as of , Loan Guaranty Provider management hadn’t drawn step so you can thing refunds to those exempt pros, the new OIG statement states.

OIG finds out it disturbing one elder VBA management was conscious tens of thousands of experts was basically possibly due more $150 billion but really failed to bring adequate steps to make sure refunds was granted, Virtual assistant Secretary Inspector General getting Audits and Analysis Larry Reinkeymer composed about declaration.

Meanwhile, what amount of veterans impacted plus the number he’s due increased, out of an estimated $150 million into the 2014 to $189 million by the end off 2017, the newest OIG analysis discovered.

The latest remark team projected that Va you can expect to are obligated to pay a supplementary 34,eight hundred exempt experts money commission refunds out of $164 million along side next 5 years in the event the sufficient controls are not accompanied to attenuate otherwise select such incorrect costs, the new report says.

But after weak for a long time to do so, the latest Va abruptly issued a press release may thirteen, only months before TEGNA’s first declaration premiered. The fresh new Virtual assistant established biggest change work is started. The production along with said Va is carrying out an ongoing interior remark considering many funds dating back 1998 to determine in the event the extra refunds are required.