When debating ranging from renting compared to. to acquire, you need to consider carefully your lives and you will funds. When you’re leasing offer a whole lot more self-reliance, owning a home enables you to build equity about possessions and may give income tax experts.

The apr (APR) ‘s the cost of borrowing across the label of one’s mortgage expressed because an annual rate. The new Annual percentage rate shown we have found in line with the interest rate, one write off affairs, and you will mortgage insurance rates for FHA financing. It will not think about the operating commission otherwise any other financing-particular funds charge you’re required to shell out. Cost was estimated by the state and you will genuine rates may vary.

Purchase: Costs demonstrated throughout the dining table become as much as step one point and therefore are according to research by the adopting the assumptions: compliant 29-year fixed, 15-seasons repaired, 7/6 Case and you will 5/six Sleeve according to a loan amount of $350,000 having a downpayment from 20%. 30-season fixed FHA centered on an amount borrowed away from $250,000 which have an advance payment of 5%. 30-season fixed jumbo and you may 10/six Appeal Simply Sleeve jumbo goods are according to a loan level of $step 1,three hundred,000 having an advance payment off 29%. Most of the financing guess one-members of the family home; pick financing; home loan speed lock age of thirty day period and you can customers reputation that have excellent borrowing from the bank. Discover estimated monthly installments. Get a hold of projected monthly installments.

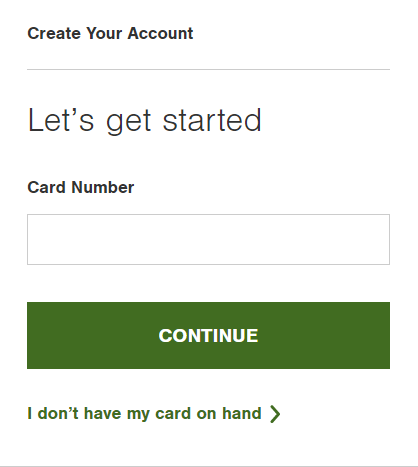

A great preapproval will be based upon a glance at income and you will house guidance you promote, your credit score and you can an automated underwriting system opinion

Refinance: Costs showed about table is everything step one discount section and are derived from the next assumptions: conforming 29-seasons fixed, 15-season repaired, 7/six Sleeve and you may 5/six Case predicated on a loan amount out of $350,000 having that loan to worth of 55%. 30-seasons fixed Jumbo and you can ten/6 Appeal Simply Sleeve jumbo goods are according to financing level of $step one,three hundred,000 which have financing to help you property value 55%. All the finance guess a single nearest and dearest residence, refinance mortgage, mortgage rate lock period of 45 months throughout claims except New york that has a speed lock age of 60 days and customers profile that have excellent credit. Find estimated monthly premiums. Come across estimated monthly obligations.

Dependant on your own borrowing character and amount borrowed, interest-simply finance arrive and provide towards percentage interesting only for an appartment time period, and costs of dominant and you may notice thereafter for the remainder of the borrowed funds identity. And come up with attention-merely repayments, prominent isnt shorter. At the end of this period, the monthly payment increases.

FHA financing want an upwards-front financial top (UFMIP), which are funded, or paid down within closing, and you may an FHA yearly home loan cost (MIP) reduced monthly may also incorporate

Fund doing 85% of an effective residence’s worthy of arrive towards a purchase otherwise refinance without cash back, susceptible to possessions types of, an essential minimum credit rating and you may the very least amount of month-to-month supplies (i. Product constraints use. Jumbo funds available as much as $9. Most constraints can get pertain. Delight contact a beneficial Pursue House Financing Mentor for facts. The DreaMaker home loan is available without-cash-out re-finance off a primary home step 1-4 product assets getting 29-year fixed-rates words. Money restrictions and you may homebuyer training path becomes necessary when all of the mortgage individuals is very first time homeowners.

Pros, Servicemembers, and you may members of the brand new Federal Guard otherwise Reserve are eligible for a loan secured from the U. S. Agency out-of Veteran Situations (VA). A certification away from Qualifications (COE) about Va must file qualification. Limitations and you will limitations pertain. The issuance from a preapproval letter isnt that loan partnership or a vow getting mortgage approval. We possibly may promote a loan relationship once you sign up therefore create a final underwriting comment, together with verification of every pointers offered, property valuation and, if relevant, buyer approval, that could trigger a switch to the latest terms of your preapproval.