It’s always important to get the best prices simple for an effective home loan when you are exploring to get a property or likely to re-finance. With MyRatePlan’s novel program, helping you get some of the best lenders is quite effortless. MyRatePlan gives you the tools and you may study you have to make a knowledgeable choices on mortgages, every go out. Once it’s possible to examine prices for various financial when you look at the Albany, Nyc hand and hand, you will be even more sure of maybe not overpaying about a lot of time follow you purchase you to brand new home.

Ways to get the best Mortgage Costs into the Albany, Nyc

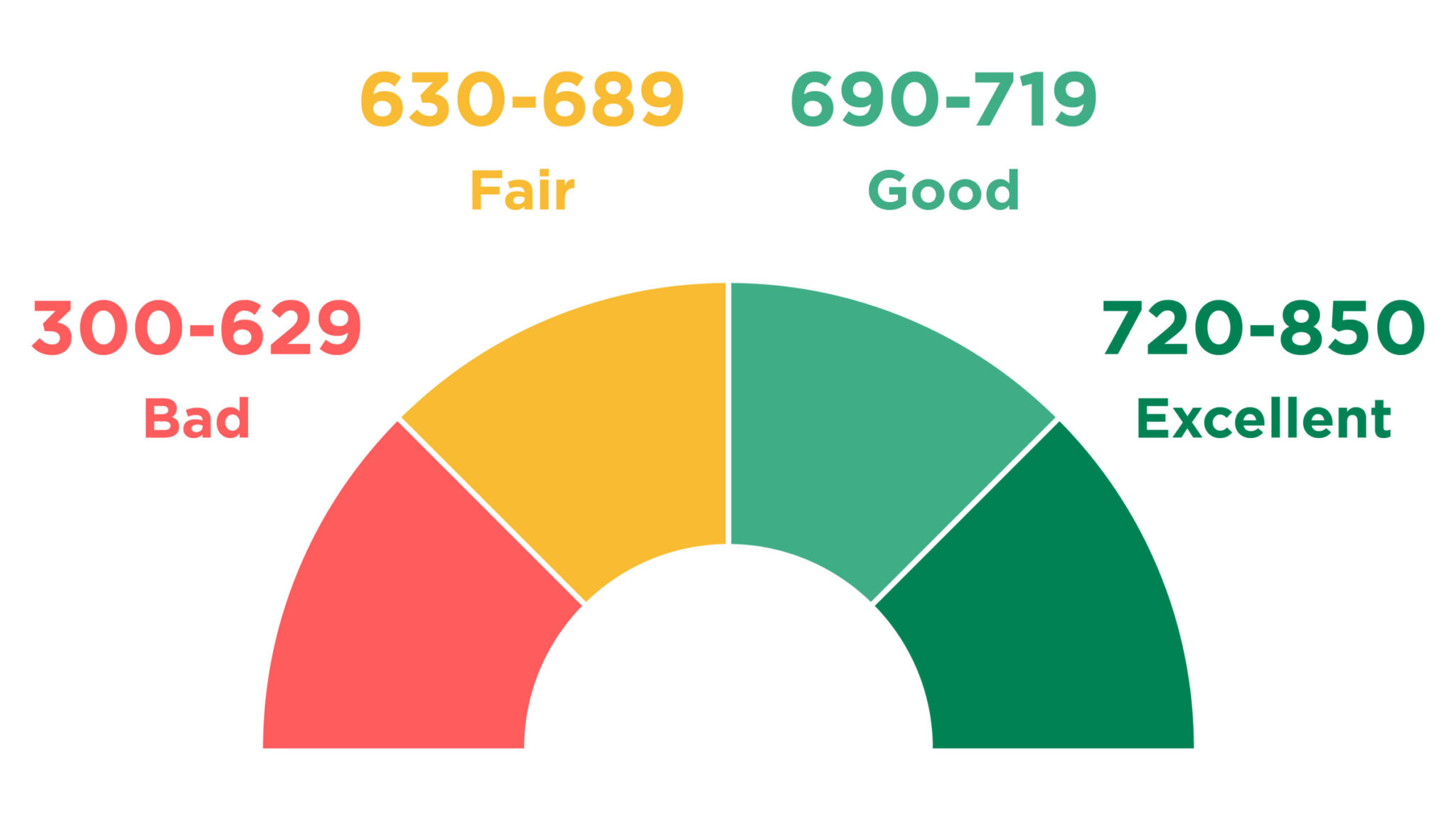

People looking to purchase a home inside the Albany, Ny are more inclined to you desire financing to purchase the brand new house. To find a property into the bucks, or using upfront, is actually a difficult proposal for many individuals, actually where property value our home can be as lower because $fifty,000. One to as the case, candidates need to find an appropriate financial which is well within their monetary prospective. You need in order to safe financing with the lowest attract pricing you can easily. After identifying the house one really wants to pick, real estate professionals usually direct customers to lenders having which it features engaged before. Buyers should always grab the recommendation having a-pinch regarding sodium. Remember your agent might not have your best of welfare from the center. The latest broker is merely trying to intimate the deal because in the near future that one can. It should be obvious by now that closure a home loan deal isn’t as easy as it may sound especially for first time customers. At this point, it’s best becoming sluggish however, sure. That way, you need get a hold of an educated bargain. No matter whether one to wants to close the business with a community lender or a massive name team. It is important is to try to lookup financial rates online. Area of the object from MyRatePlan’s home loan speed product is to assist you support the cheapest financial cost within the Albany, Nyc. The better your credit rating, the better your interest rate would-be. Credit scores are very important while they myself affect the mortgage appeal costs that you can sign up for.

The types of Mortgage brokers For sale in Albany, New york

As the you will find an extensive selection of other customers nowadays, it seems sensible that there exists along with a lot of additional loan circumstances in the business, as well as repaired-speed mortgages and you will changeable lenders. Those individuals are two of the most extremely prominent style of mortgages, and each commonly fit different types of consumers.

If the buyer will get a predetermined-rates mortgage in the Albany, New york, their attention price remains a comparable about whole financing label, whether or not one to lasts for 10, 20 or 3 decades. Into the rate of interest staying a similar, the brand new payment per month number in addition to stays an identical. A fixed-rate financial is a safe option, given that buyer never has any unexpected situations having simply how much the domestic percentage was.

As their term implies, adjustable-speed mortgage loans (ARMs) within the Albany, New york don’t possess one to lay interest. Alternatively, the interest rate can go up or off. Widely known sorts of Sleeve are a mix of a keen Case and you may a fixed-rate mortgage, both described as a hybrid Arm. For a first several months, the borrowed funds has actually a fixed rate of interest. Following, new mortgage’s interest adjusts with the a fixed plan. Such as for example, a purchaser may get an excellent six/2 Case. New half dozen implies that the mortgage have a fixed rate having the first half dozen decades. The two means up coming 1st several months, the interest rate changes the 2 years. The trouble which have Possession is the fact that the borrower’s payment you’ll increase.

FHA Mortgage loans in the Albany, Nyc

Deciding between fixed-price mortgage loans and you can Possession isn’t the only choice a prospective debtor need to build. They also have to imagine if they need to adhere to traditional mortgages otherwise score a federal government-insured home loan. That have traditional mortgage loans, the newest deal is actually within financial therefore the debtor. In case the borrower defaults, the lender you can expect to generate losses. That have regulators-insured mortgages, government entities was support the loan and you may assisting to security the fresh financial in the event the a default happen. These mortgage comes with USDA finance, Va fund and you may FHA money.

Government Construction Administration (FHA) mortgages enjoys home loan insurance provided with the new FHA, which is itself managed from the government’s Agencies out-of Housing and Urban Advancement (HUD). Which have FHA finance during the Albany, payday loan Riverside New york, it’s not merely basic-big date buyers that can meet the requirements but whichever buyer. Consumers benefit from FHA money due to the fact down money will likely be simply 3.5 % of your house’s price, however, in addition, however they need to pay the loan insurance coverage monthly, which makes their house commission more high priced.

Refinancing home financing from inside the Albany, Ny

While the term try commercially refinancing, exactly how this process works ‘s the borrower enforce to possess a good brand-this new financial, which they use to afford the earlier financial. The point of refinancing is the fact that new mortgage features an excellent finest interest rate than the old that, and therefore means the latest debtor preserves money if you are paying shorter focus with the rest of their financing. The fresh new debtor is always to mention any extra will cost you that are included with the fresh new the financial, because there would-be costs and closing costs involved. It is necessary that they carry out the math to ensure that they’re indeed saving cash when men and women fees are taken into account. But not, in the event your borrower was after switching out of a supply to help you a fixed-price financial, that’s usually a good disperse since they are maybe not at the compassion from what will happen with rates of interest, hence tend to improve, not decrease. Whenever mortgage refinancing, it’s important towards the borrower to get their credit rating over 700 and reduce their financial obligation-to-money ratio to seem as reduced exposure as you are able to in order to potential lenders and secure the lower you can interest. Luckily that also a debtor whom doesn’t fulfill all high requirements you will nonetheless come across home financing for the Albany, New york with a low interest.