- How will you Close a HELOC?

- Just how long Do Closing to your a good HELOC Generally speaking Take?

- What are the results Throughout a good HELOC Closure Techniques

- Getting The Personality or other Records

- Taking Homeowner’s Insurance coverage and you can Examination

- Planning Your own Financing

- Examining and you may Signing regarding Paperwork

- Animated out-of Name

- Exactly what Else Are you willing to Anticipate Through the Closure?

You put in the efforts to construct equity on the home with for each and every monthly mortgage repayment. Now, it is the right time to money in and make use of one collateral to pay for people costs, anywhere between renovations and you will getaways to school tuition and you will scientific expenses. Immediately following performing new legwork to try to get financing, bring monetary data, and wait for underwriting processes, it’s time to close in on the investment. Of a lot residents make use of their property equity which have an excellent HELOC, hence functions much like a credit card. It’s got a threshold and you will a variable interest rate you to definitely influence how much cash your pay-off.

New closing process happen over a planned day between your residents and also the financial. You are going to need to done several procedures in this processes to access their house’s security. Focusing on how the closure techniques functions and just what you’ll need can be save time and get the money in the course of time. You won’t want to see a closing unprepared once you are so next to taking the fresh money.

How can you Close an excellent HELOC?

After the underwriting techniques, the financial institution have a tendency to extend and permit that schedule a great closing time and date. The lender will program a meeting ranging from its agencies and you may the home people to the picked day. You’re going to have to offer numerous documents or any other guidance throughout the brand new closure technique to be certain that it goes efficiently. While you can apply to have a HELOC on line without getting into the telephone having an agent, you must see their bank at the a location part otherwise because of an on-line conference label.

More often than not, the fresh HELOC techniques requires 3-6 days, it varies for every single bank. Financial institutions and you can borrowing unions normally take more time, although you will get an excellent HELOC shorter that have an online bank. You’re going to have to get cash organized and construct the credit to improve your chances of bringing recognized and finding yourself having a lower life expectancy interest. Home owners will also have add the mandatory documentation while having anyone to appraise the property. Some loan providers use an automated valuation model one to eliminates you prefer to have an enthusiastic appraiser, however, many loan providers require an appraisal. The latest appraisal tells the lending company how far dollars they could enable you to borrow in accordance with the property’s security.

What takes place While in the a good HELOC Closure Process

The new closure processes ‘s the final action of getting your house collateral personal line of credit. Into finishing line around the corner, it is vital to sit focused to ensure zero hiccups over the ways. Below are a few of the things https://paydayloanalabama.com/town-creek/ we offer for the closing process.

Taking Your own Personality or any other Records

Property owners need present the personality and other legal files, particularly the Social Coverage Notes. Identity theft & fraud has become an enormous matter, and lenders must be certain that your own identity just before allowing you to borrow currency. Extremely lenders give a listing of necessary documents so you’re able to the new closure is also go ahead with no factors.

Getting Homeowner’s Insurance rates and you can Check

Homeowner’s insurance is not an appropriate criteria, but when you need to get a home loan otherwise HELOC, you need to get this insurance. Very finance companies, borrowing from the bank unions, an internet-based lenders like to see your own homeowner’s insurance coverage just before providing financing. You can even need bring information about a property check in the event your financial did not explore an automated valuation design. Lenders have fun with inspection reports to guage its exposure. The lending company may take your home for people who standard on loan, and you can an assessment support the lender know if they are set for a project just in case you can not pay-off the mortgage.

Very banks, borrowing from the bank unions, and online loan providers will work along with you to eliminate you to circumstances. Including, they could receive you to get a good refinance to increase your own mortgage and reduce monthly installments. Loan providers along with would not bring your home if you are a few days later on the first fee.

Planning Their Fund

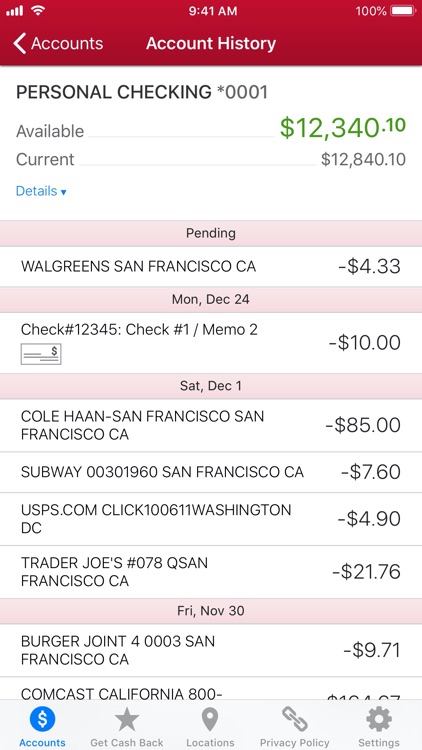

Closings are fascinating because you get the additional funding, but they are and expensive. Closing costs reflect the work you to ran to your undertaking the mortgage plus the legal services that finish new agreement. You may need to pay dos% so you’re able to 5% of loan’s harmony given that settlement costs. Gathering money today will help you to spend less, but some banks will get will let you move the settlement costs into your mortgage. It’s a good idea to prevent this package if you possibly could while the moving along the settlement costs also makes them at the mercy of the fresh new loan’s interest. You are going to need to shell out closing costs even if you never ever borrow secured on your house equity credit line.

Reviewing and Finalizing away from Files

Be sure to double-read the paperwork in advance of bringing their signature. A resident should make sure the fresh new HELOC count and you will interest satisfy the amounts they agreed to before. For individuals who commit to the fresh terms and conditions, you must indication the brand new papers in order to proceed to the next step.

Move regarding Title

A property collateral credit line towns and cities an effective lien on your family. This transfer form the bank, credit commitment, or on the internet lender can also be lawfully get your residence for folks who slip at the rear of toward loan money. New lien becomes removed when you pay the home guarantee credit line and personal your account.

Just what Else Do you Predict While in the Closing?

Absolutely nothing much comes after you indication the new documents while the label gets directed. By firmly taking away an excellent HELOC to your an investment property, you will get the loans on your own family savings shortly. People through its top home to the HELOC have around three business weeks to believe it more prior to searching the money. A resident can call off the newest HELOC in this people three days whenever they feel a distinction from cardio. They are going to get the funds after that three-go out months comes to an end.

After you receive the money, you can use the latest HELOC in any way you want. Homeowners normally buy home improvement services, rating a resort booking for their 2nd holiday, otherwise safeguards an emergency bills. HELOCs offer great flexibility, therefore do not shell out focus unless you borrow money from the personal line of credit. This provides your more hours to believe more than the method that you wanted to pay the cash, while won’t need to love borrowing from the bank an excessive amount of cash. For individuals who took out a top HELOC than simply expected, you can keep that money about personal line of credit and you will maybe not value a lot more expenses.