- How will you Intimate an excellent HELOC?

- The length of time Do Closure on the an effective HELOC Typically Grab?

- What happens While in the an excellent HELOC Closure Techniques

- Providing Your own Character and other Data

- Providing Homeowner’s Insurance policies and you will Review

- Planning Your own Fund

- Examining and you can Finalizing out of Documentation

- Mobile away from Name

- Exactly what More Do you really Assume While in the Closure?

You’ve put in the persistence to construct equity on your house with each month-to-month homeloan payment. Now, it’s time to profit and employ you to equity to pay for any debts, ranging from renovations and you may getaways to college tuition and scientific costs. Immediately after carrying out this new legwork to try to get a loan, give economic files, and you will wait for underwriting processes, it is time to close-in in your investment. Many property owners tap into their property equity having good HELOC, which features similarly to credit cards. It has a limit and a changeable rate of interest you to influence how much your pay.

The brand new closure procedure happen more a scheduled go out involving the residents and bank. You’re going to have to done a few methods with this procedure to access the house’s collateral. Focusing on how this new closing process really works and you will just what you’ll need can help you save some time and ensure you get your financing sooner. You won’t want to head to a closing unprepared once you are next to providing the newest resource.

How do you Close a great HELOC?

Adopting the underwriting techniques, the lending company commonly touch base and invite you to agenda good closing time and date. The financial institution will likely then strategy a meeting anywhere between its agents and the property residents for the selected date. You will need to render several data or other suggestions throughout the fresh closing strategy to make certain it goes effortlessly. While you can use having an excellent HELOC online without being towards the phone that have an agent, you have got to fulfill their bank at an area branch or compliment of an online conference phone call.

In most cases, the new HELOC processes requires step 3-six months, but it may differ for every bank. Loan providers and you can borrowing from the bank unions generally take more time, even though you can get a good HELOC less which have an online bank. You’re going to have to get the money organized and create your own credit to boost your chances of taking approved and finding yourself with a lesser interest. People may also have to submit the desired documents as well as have you to definitely appraise the house or property. Some lenders fool around with an automated valuation design you to eliminates need to own an appraiser, but many loan providers wanted an assessment. The latest assessment informs the lending company about how far dollars they may be able allow you to borrow in accordance with the property’s collateral.

What the results are During the a great HELOC https://paydayloanalabama.com/pine-apple/ Closure Process

The brand new closing procedure ‘s the latest action of having your residence equity credit line. Toward finish line coming soon, it is very important stand concentrated to make certain no hiccups across the means. Below are a few of all things we offer for the closure processes.

Getting The Identification or any other Data

Property owners need to establish the identification and other judge records, such as its Public Protection Cards. Id theft happens to be an enormous material, and you may lenders need certainly to verify their title just before enabling you to acquire money. Very loan providers offer a listing of expected data so you’re able to the new closing is proceed without the items.

Providing Homeowner’s Insurance coverage and you will Review

Homeowner’s insurance is not an appropriate requirements, but when you want to get a home loan otherwise HELOC, you ought to get this insurance. Extremely banking companies, borrowing unions, and online loan providers want to see your own homeowner’s insurance policy ahead of getting finance. You are able to need to provide factual statements about a house review if your bank don’t fool around with an automatic valuation design. Loan providers fool around with all about home inspections to gauge the chance. The bank takes your house for many who default to your mortgage, and you can a review facilitate the lender discover if they are set for a job just in case you cannot repay the borrowed funds.

Most finance companies, borrowing unions, an internet-based loan providers work to you to stop that scenario. Such as for instance, they might invite you to receive a re-finance to extend the loan and lower monthly payments. Lenders and wouldn’t take your domestic while you are a short time later on your own earliest payment.

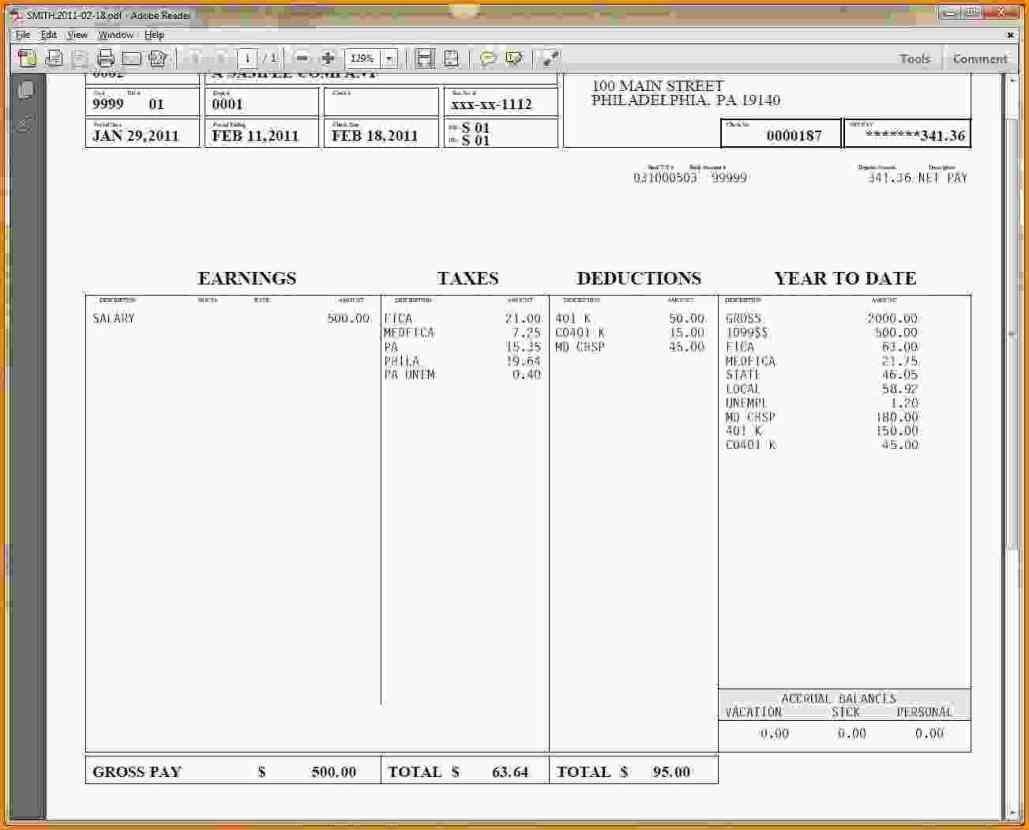

Getting ready Your Loans

Closings are fun because you have the extra money, but they are in addition to pricey. Settlement costs echo work one went toward creating the loan as well as the legal services you to definitely completed new agreement. You may need to pay 2% in order to 5% of your loan’s harmony as the settlement costs. Gathering finance today allows you to spend less, but some banking institutions get enables you to move the closing costs into the financing. It’s better to cease this if you’re able to just like the rolling along side closing costs and additionally makes them at the mercy of the brand new loan’s interest. You’ll have to pay settlement costs even if you never borrow against your residence security personal line of credit.

Evaluating and Signing off Documentation

Make sure you double-see the files before providing the trademark. A homeowner should make sure the HELOC number and interest match the quantity they accessible to before. For individuals who commit to this new conditions, you must indication the files to move on to the next step.

Mobile out-of Term

A house security personal line of credit urban centers good lien on your own family. That it import mode the lending company, borrowing union, otherwise on line financial can be legally obtain your home if you fall about to the mortgage costs. The latest lien gets removed once you pay-off our home equity credit line and you will personal your bank account.

Just what Otherwise Could you Assume Through the Closing?

Absolutely nothing much can come after you indication new files additionally the title becomes directed. By taking out an excellent HELOC toward an investment property, might receive the finance on the checking account shortly. Property owners with regards to primary residence for the HELOC possess three business months to believe they over before finding the money. A homeowner can be call-off this new HELOC in this those people three days when they feel a significant difference away from heart. They will receive the fund after that around three-day months closes.

After you get the financing, you are able to brand new HELOC in any way you desire. Residents normally invest in do it yourself features, rating a lodge booking for their 2nd vacation, otherwise shelter an urgent situation expenses. HELOCs offer higher flexibility, and you also you should never pay attention unless you borrow funds resistant to the credit line. Thus giving you more time to believe more the method that you need to pay the cash, and you won’t need to worry about borrowing continuously dollars. For folks who grabbed out a higher HELOC than simply requisite, you can preserve that cash in the credit line and perhaps not love a lot more costs.