In the blog post-pandemic day and age, home loan prices strike the highest level in many years while the Government Reserve boosted the standard rate of interest to combat rising cost of living.

Fortunately the brand new central lender has begun so you’re able to contrary path, reducing rates 50 basis items during the a recently available September conference during the reaction to cooling rising cost of living. Mortgage rates are already off over a point from other peak – and gurus endeavor then price falls that it fall and a continued and you will towards 2025.

Future homebuyers can benefit from all of these rates declines, with quite a few looking to day its entryway on sell to get the best prices. Yet not, most recent home owners with high priced fixed-rate loans won’t automatically feel impacted by modifying field requirements. It offers remaining certain wanting to know regarding the probability of home loan speed modification.

What exactly is a mortgage rate of interest amendment?

Fixed-speed mortgages routinely have terminology set for the life span off the mortgage and should not end up being altered in the place of refinancing. Although not, you will find some exceptions.

“As the cost continue steadily to decline, specific loan providers will offer an increase modification so you can current customers so you’re able to try to keep its financing unlike shedding them due to the fact refinances for other banks,” claims Sarah Alvarez, vice president out-of financial banking from the William Raveis Home loan. “The pace amendment allows the newest debtor for taking benefit of another type of lower rates without the need to look at the entire mortgage acceptance techniques once more.”

There are will fees of the rates variations and you may constraints to your how frequently you could make use of all of them, Alvarez says. Also they are unavailable for the the money. Should your financial cannot provide this, you’re certain stuck together with your current rate unless you re-finance so you’re able to a unique loan otherwise qualify for a wider home loan amendment to own individuals struggling to make costs.

“In home financing modification, a borrower who has got overlooked repayments, or who’s inside imminent threat of forgotten costs, requests the fresh terms of the present home loan feel adjusted to let this new borrower to treat any non-payments and steer clear of property foreclosure,” states Igor Roitburg, senior controlling movie director regarding Stretto, a personal bankruptcy characteristics and tech company.

Roitburg says you to definitely adjustments on the loan trust exactly who the fresh trader was, however, that frequently a speed get rid of falls under the offer.

“Normally, whenever a home mortgage modification is approved, the mortgage servicer will to switch things such as the interest rate and the remaining name of your own established loan in order to make a great fee one to falls from inside the modification assistance by which the new servicer is limited,” Roitburg states.

“Normally, with a beneficial recast, you might be only putting an enormous sum towards the the main balance,” says Christina McCollum, a producing sector chief to have Churchill Mortgage. “It creates a separate harmony the new fee was determined because of the, thus you may be altering the total amount being paid back on your own mortgage, however it does not eventually alter the financing title or loan interest rate.”

How do you qualify for a mortgage rate amendment?

To your Given signaling multiple rate incisions are on their way, anyone to acquire a house today will want to look during the whether loan providers they are provided offer these types of system.

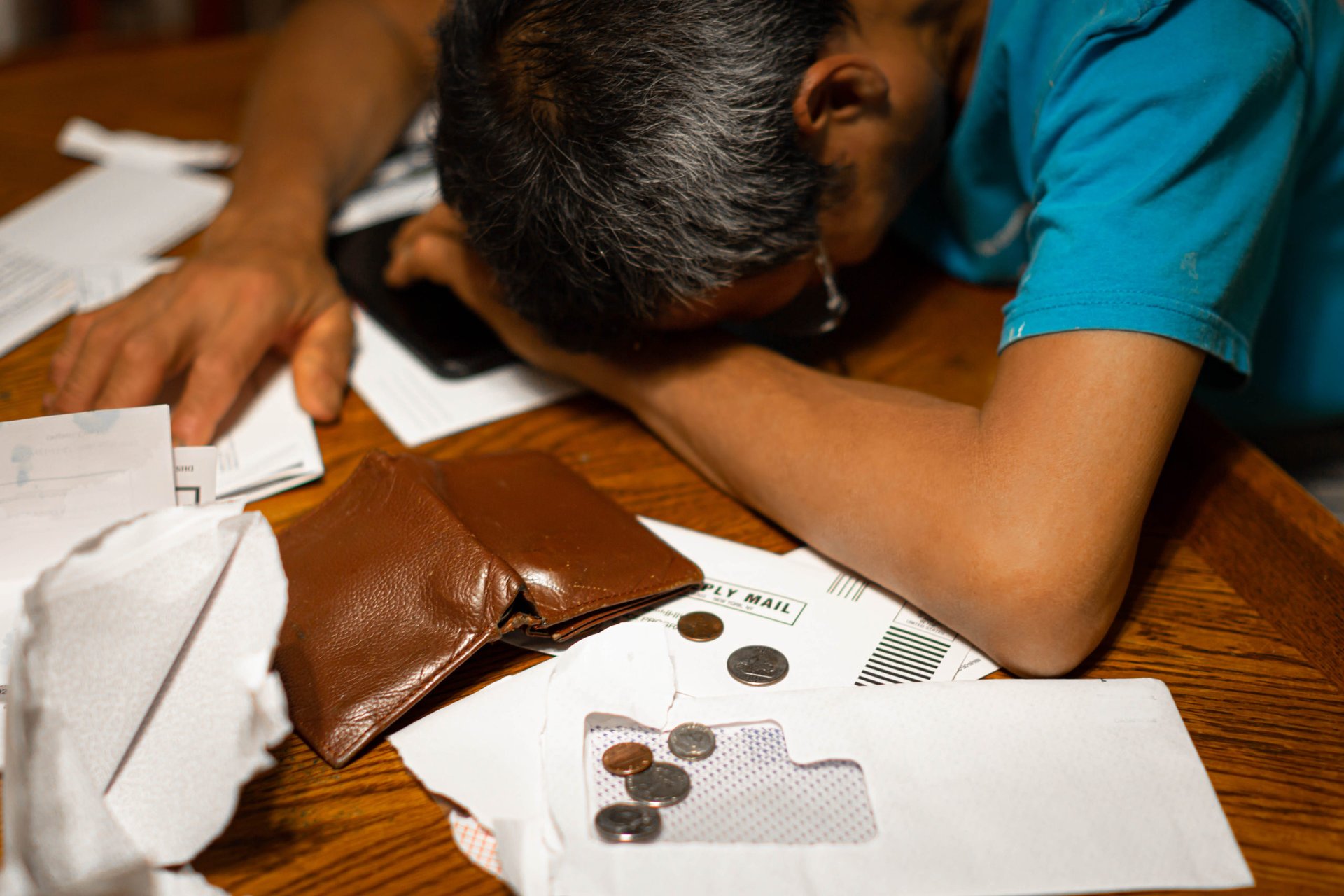

If you’re getting a rate change within a broader mortgage loan modification, yet not, you might need qualify centered on economic concerns.

“Are entitled to a loan amendment, the new debtor usually need to be during the standard or vulnerable to default,” Roitburg states. “With regards to the amendment apps readily available, a debtor carry out generally make an application for a modification because of the submitting an application discussing their financial predicament and you can adversity together with documenting their sources of income.”

Roitburg claims that there’s tend to certain back-and-onward with loan providers asking for more info in advance of comparing this new document to determine whether your debtor qualifies to have modification.

“Due to the fact plan is finished, the fresh servicer assesses the applying,” he states. “If this find the borrower is approved, the servicer will send the brand new terms, that could otherwise may not were a customized interest rate. It depends toward programs the latest individual can offer.”

Unfortunately, individuals whom acquired loans pre-pandemic usually have less options for a rate get rid of as opposed to those exactly who took aside finance more recently. Which is as a result of the change in prevalent cost.

“Many of the mortgages which were made previously currently had apparently reasonable rates and you will the current interest levels try highest from the evaluation,” he says.

Nonetheless, you will find some choice also situations where loan providers manage a great “independent, subordinate, interest-free financial to own area of the debt that can’t become paid during the time.”

Just who should think about a home loan rates modification?

In case your bank now offers a performance amendment when mortgage rates shed , you ought to make the most of they when you find yourself qualified. There is absolutely no need to not ever spend reduced to suit your loan by the engaging in speed modifications apps, providing you wouldn’t disperse up until the deals you know regarding down price compensate for one fees their bank costs.

Mortgage loan modification due to pecuniary hardship, simultaneously, is actually a separate tale. Since you must be in standard or in threat of default becoming eligible, your home is at stake in this instance. Not paying your residence loan, otherwise expenses late, may also manage big damage to your credit rating. Your definitely will not want losing about towards payments unless you have no other option.

However, while you are troubled and cannot protection your houses can cost you, you should speak to your financial as fast 400 loan as possible to track down out regarding the modification apps. You may be far better from finding ways to create your payment so much more affordable in the place of destroyed repayments and risking property foreclosure.

Advantages and disadvantages regarding seeking a home loan price amendment

Stand alone rate modifications as part of a loan provider system has actually couples cons, provided the cost try sensible. The new upside is leaner monthly payments and you will less speed.

Once again, regardless if, some thing become more tricky whenever getting hardship modification. This new upside is you might get to help keep your house, although downside would be the fact the borrowing was broken given that your miss money before the brand new amendment. After that, until your lender profile the loan because the “reduced once the concurred,” while you are engaging in the modification program, your own rating continues to bring a hit.

Ahead of given a loan amendment, you need to mention choice, such as for example refinancing in order to a cheaper rate or stretched payoff go out, both of which could potentially reduce your monthly costs without any drawbacks from doing a loan provider modification system. This type of alternatives may not be readily available while in the days of monetaray hardship even in the event.

The conclusion

Fundamentally, fortunately you to straight down costs is available to choose from and you may alot more options for sensible home loans feel available every single day. If for example the mortgage payments otherwise most recent speed are greater than you’d such as for instance, consider the options now.

While speed modifications are not accessible to merely individuals, there are choice such as for instance refinancing that will help anyone who has lent in recent times so you’re able to possibly miss the rate considerably and more reduce each other the monthly payment in addition to interest they shell out throughout the years.