Domestic Security Financing compared to. Domestic Security Personal line of credit

Thinking what to choose from property collateral mortgage versus good home security credit line (HELOC)? Your quest getting responses is more than!

Since your safest mortgage broker during the Vancouver, we carry out to we are able to to greatly help our customers build informed conclusion in using their home security. In this post, we integrated all you need to find out about the main variations anywhere between a property collateral loan and a property equity distinctive line of borrowing from the bank.

Do you need currency to own a house improvement enterprise, so you can combine financial obligation, link mortgage, publication children escape, or to pay your children’s educational costs?

When you’re a citizen for the BC, Canada, being required to loans a massive or unforeseen costs, your property equity’s worthy of provides you with a couple borrowing from the bank choice: to acquire a home equity financing, or a property guarantee credit line (HELOC).

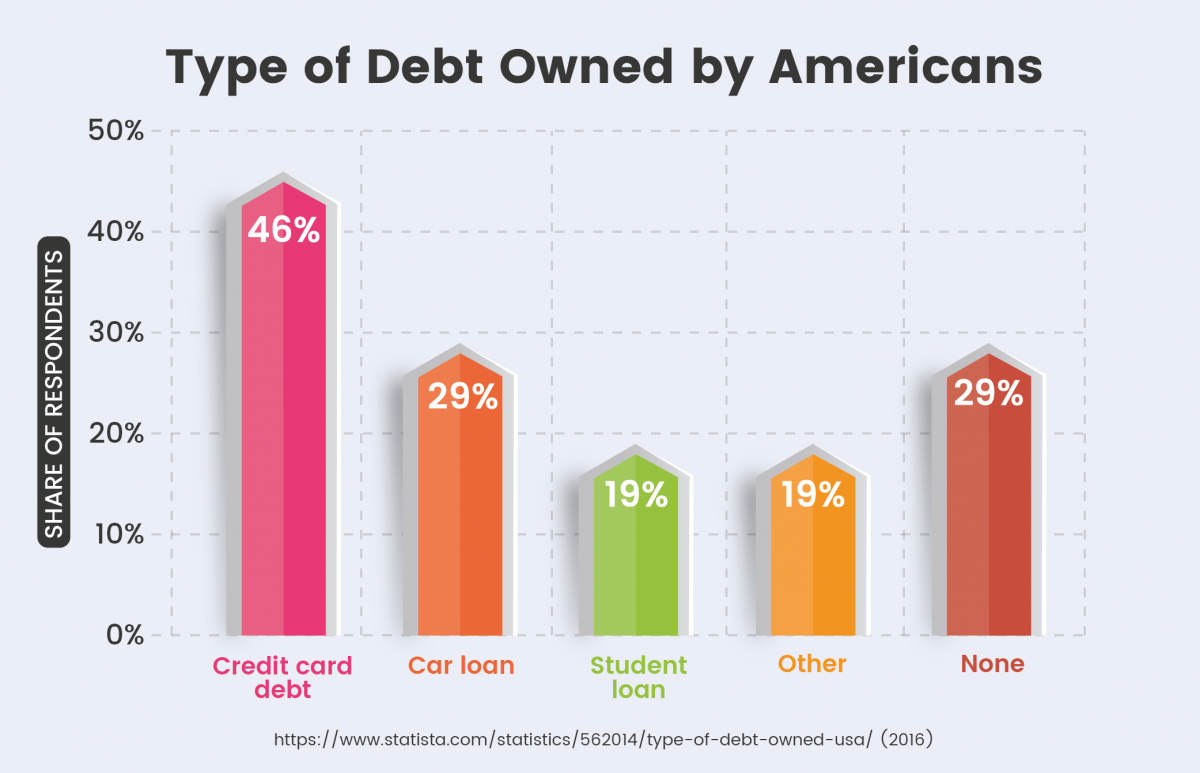

That have interest levels normally below other kinds of monetary selection (such as handmade cards otherwise unsecured loans), these financial products are commonly called 2nd mortgage loans.

The key to knowing which to decide ranging from a house guarantee financing versus a home equity credit line, try thoroughly understanding the pros and cons for each and every one to.

Advantages and disadvantages from Domestic Guarantee Money

Both these style of fund make use of your home since a security just like mortgage loans do. But that’s practically all he’s in accordance!

Part of the difference in household collateral loans and you will house equity contours out of borrowing is that a property equity mortgage makes you use most of the money at a time.

Such as for example traditional financing, a home equity mortgage has fixed monthly obligations, interest rates and you will repayment conditions. These types of make sure they are a less dangerous and you can foreseeable option than just HELOCs. Knowing how much you borrowed from per month in the life time of mortgage, together with sum of money you pay right back in the the conclusion will likely be calming for the majority. That’s more possible during such as an unstable economic and you may economic climate from inside the 2020 pandemic.

Apart from predictability, yet another added benefit of so it economic tool is that the notice you pay toward financing is generally tax deductible.

A significant part in the event whenever deciding between a property guarantee financing compared to property guarantee line of credit ‘s the standard bank you plan to address.

With finance companies otherwise borrowing from the bank unions, the financing restrict you can borrow could well be constantly restricted to that loan to help you well worth and you will income ratio. Apart from the fresh new appraised property value your home, which proportion along with takes into account your revenue condition, credit rating otherwise credit history statement. And because of your COVID-19 pandemic in addition to ensuing monetary surprise, banks’ approvals try actually harder. This will make it hard for of numerous property owners to be eligible for the borrowed funds needed.

When working with an established large financial company in BC, hardly any other items other than how much cash collateral you have got extra home based number. Our very own selected private loan providers from inside the Vancouver has actually many financing alternatives for everyone. Their choices match any borrower’s finances, even the very challenging ones.

Now for the best area: several of the lenders does not cost you an effective prepayment punishment in case you should repay the loan just before schedule, like any banking companies constantly manage.

Pros and cons out-of House Equity Lines of credit

When considering things to choose between property guarantee mortgage against a property collateral line of credit, you have to know that HELOCs works for example handmade cards.

An effective HELOC will give you the means to access a credit line so that you can obtain only a small amount otherwise doing you prefer. In the end, you will simply need to pay back extent you’d made use of.

This financial tool has several periods, a suck months and a repayment period, and you will changeable rates that can remain lower or perhaps not, according to index action.

And in case you inquire just what a list fluctuation comes with, it can be affairs instance how much you obtain, your own rate of interest together with market’s volatility.

Normally, the tiniest monthly installments will cover the eye in the draw period. However, since the some other lenders have some other also offers, for almost all HELOCs make an effort to spend a huge swelling sum at the end.

When comparing the distinctions ranging from a home security loan and you may a home collateral line of credit, such mortgage keeps that major work with: self-reliance. HELOCs are used for whatever you need, but they are most useful suited for home fixes and you may repair that will improve Bon Air loans your home’s value.

As with possible from household guarantee financing, private loan providers noticed the possibility right here too. Many individuals you to definitely finance companies deny, are able to paying off their fund. That’s why, if you are looking based on how locate good HELOC no income otherwise that have a weakened credit history, our very own B-lenders from inside the BC helps you thereupon as well.

Wisdom borrowing products is tricky and you will opting for it’s possible to require counsel from an experienced economic mentor. So why not contact us today and now we is discuss the state detail by detail. We could decide to each other and that product is ideal suited to you between property guarantee loan against a home equity type of borrowing from the bank. We are able to also show you on greatest financial on the most affordable terms and conditions.