- A good 2022 data shows that people spent an average off $22,000 toward renovations.

- Money options are designed for financial support property opportunity, such as for instance equity fund, credit cards, and refinancing your own home loan.

- Once you understand assembling your project timeline and you will security makes it possible to buy the best option to you personally.

Owning a home has inescapable repairs and/or want to offer their space an upgrade. A recent study showed that in 2022, home owners spent a median away from $twenty two,000 to your home improvements, with over fifty% of those browsing spend no less than $fifteen,000 toward updates.

But do not allow price of this type of methods scare you away. An abundance of funding options are offered that will create every difference in getting one family restoration or fix your, out-of a cooking area upgrade in order to a roof substitute for or water damage repair. Navy Government Credit Partnership, like, now offers various alternatives for the players according to scale out-of their residence opportunity.

“We always share with the players to consider their renovation goals and you can current financial situation,” said Adam Fingerman, secretary vice president off guarantee lending in the Navy Government. “After that, we shall assist them to restrict the choices to get the best investment equipment to match their needs.”

There are various loans that suit different varieties of tactics. Fingerman implies carrying out assembling your project by getting a price of extent of work, the fresh new schedule, as well as the costs. Those individuals points makes it possible to choose which loan helps to make the most sense for the renovation otherwise fix.

2. Household guarantee personal line of credit (HELOC) is a flexible selection for high programs

Property security line of credit, which has an adjustable rate, allows you to make use of the security in your home as guarantee in order to borrow cash into a concerning-needed base, up to your credit limit. This is a good choice for people who have a much constant do-it-yourself projects.

3. Household security finance finance a single-day venture

A house guarantee loan provides a one-day lump sum regarding financing from the borrowing against the equity inside the your residence. This really is ideal for a bigger-level, one-big date enterprise that really needs a certain number of funding for example a share, results inform, otherwise renovating an individual room. As you pull out all the money initial, you can plan any project that have a very clear funds during the brain. On the other hand, that one has a predetermined rate of interest for the whole time of the borrowed funds.

4. Refinance your house to pay for a project

A profit-out re-finance was a mortgage choice enabling you to acquire additional money by the refinancing your existing home loan and you may tapping into their compiled house security.

5. Do-it-yourself financing bring investment getting planned repairs

A home improve mortgage has the benefit of financing initial without needing guarantee. Repayments are prepared at the a predetermined price, taking stability and you may predictability about repayment several months. Best of all, at Navy Government, you might normally located capital on the same day your incorporate, so it is an excellent option for show enhancements otherwise remodels such as surroundings otherwise grass overhauls.

six. Private expense loans money immediate repairs

Personal debts fund are of help having investment go out-painful and sensitive house expenses while they normally have a faster application techniques than many other finance. This is exactly ideal for “a wide number of house-related expenses of course, if you need money easily,” Fingerman told you.

7. Contemplate using a credit card having quicker ideas

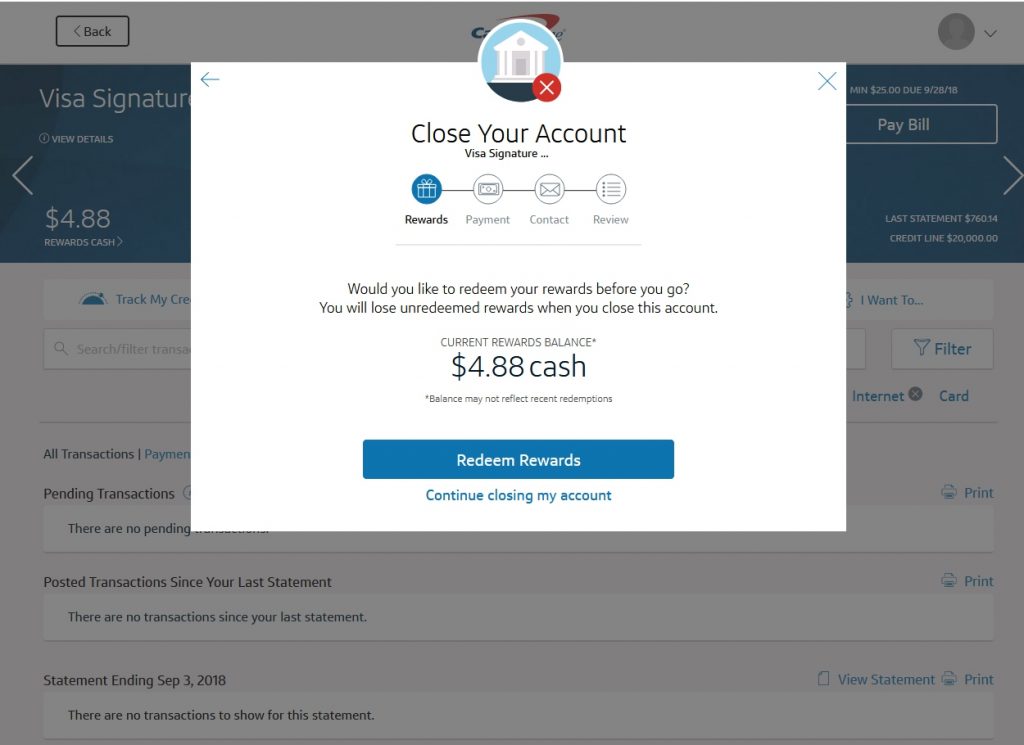

“Some people do not want to leverage credit cards to possess funding home improvement programs, these can getting a unique money selection for residents,” Fingerman said.

He recommended with your getting quick systems that one can shell out away from rapidly. On the other hand, by using a perks bank card, you can make perks and you will issues for the commands.

For example, this new Navy Government Leading Benefits Charge card would-be a option for time-to-day or reduced instructions, since you can earn situations once you spend. Navy Federal’s low-advantages Rare metal Charge card is an additional bank card option for large family ideas or crisis repairs as it possess their lowest readily available bank card Annual percentage rate.

Your property will be a smart capital

Think what are you doing in the one another a national and you may regional level inside the market industry. Understand what types of renovations is actually it loans Blue River is incorporating resale value and so are popular with potential customers when you do to market later. Eventually, it is critical to perhaps not spend more than just you really can afford.

“Navy Government also provides mortgages that have 100% financing choices, rates matches make certain, no personal mortgage insurance (PMI) called for, among other gurus,” Fingerman told you. “Additionally, we follow you toward longevity of the loan – making sure our very own qualities are available to you whenever you want it.”