New Federal Home loan Financial (FHLB) Program continues on their reputation taking exchangeability to its insurance rates company members using individuals field requirements.

Jump in order to:

Inside prior blogs, step 1 NEAM has known as insurance rates industry’s attention to the newest FHLB program. The advantages of the applying are many and in this type of not sure times, far more associated. Insurance policies companies’ spent asset swimming pools aren’t immune in the monetary drama getting inflicted by personal distancing steps delivered to stalk the fresh new spread regarding COVID-19. In times out-of market be concerned, described as increased volatility and you can declining investment cost, the capacity to provider a unique method away from resource (albeit secure) without the need to sell property on the dislocated avenues is useful.

FHLB Assessment

To help you review, new FHLB Bank system include 11 local banking institutions which might be bodies sponsored businesses authored beneath the Government Home loan Lender Work regarding 1932 and you may regulated by the Federal Homes Fund Company (FHFA). Working as cooperatives, the new FHLB finance companies make an effort to resource and you can after that render reputable, discount money so you’re able to user organizations making sure that such as for instance fund try following always offer financial support in a property and area innovation. FHLB banks finance by themselves because of personal debt issued with the a combined and you may multiple basis to the financial support , the latest combined organization got as much as $step one.1 trillion within the assets, the latest widespread percentage of and that contains $641 mil advances designed to their user associations (58% of one’s joint FHLB entity’s advantage feet). dos

Insurance agencies as well as the FHLBs

In the example of insurance providers, improves about FHLB enjoys typically become useful for a choice off spends; particularly becoming a ready way to obtain exchangeability, decreasing total cost off money given the FHLBanks’ higher get, giving greater economic flexibility, assisting ALM and you may assisting for the financial support portfolio government. In recent times, this could had been done by augmenting down financing yields. In the present ecosystem, use of exchangeability can help assist protect from the fresh need promote ties confused or alternatively, flexible money throughout the resource areas whenever cash is reduced however, opportunity sets try glamorous. As locations do not run using an appartment schedule, becoming a member of an enthusiastic FHLB encourages the ability to supply money, regardless of the intent, at the desired moments. Up to now, apart from how much cash purchased registration stock, financing can be acquired if needed, and you can desire is only repaid to the improves when removed. Take note activity inventory needs to be ordered in the event that a progress are pulled. This has the benefit of professionals specific optionality with the when you should access loans and you can allows players as versatile in the time of its explore of one’s program.

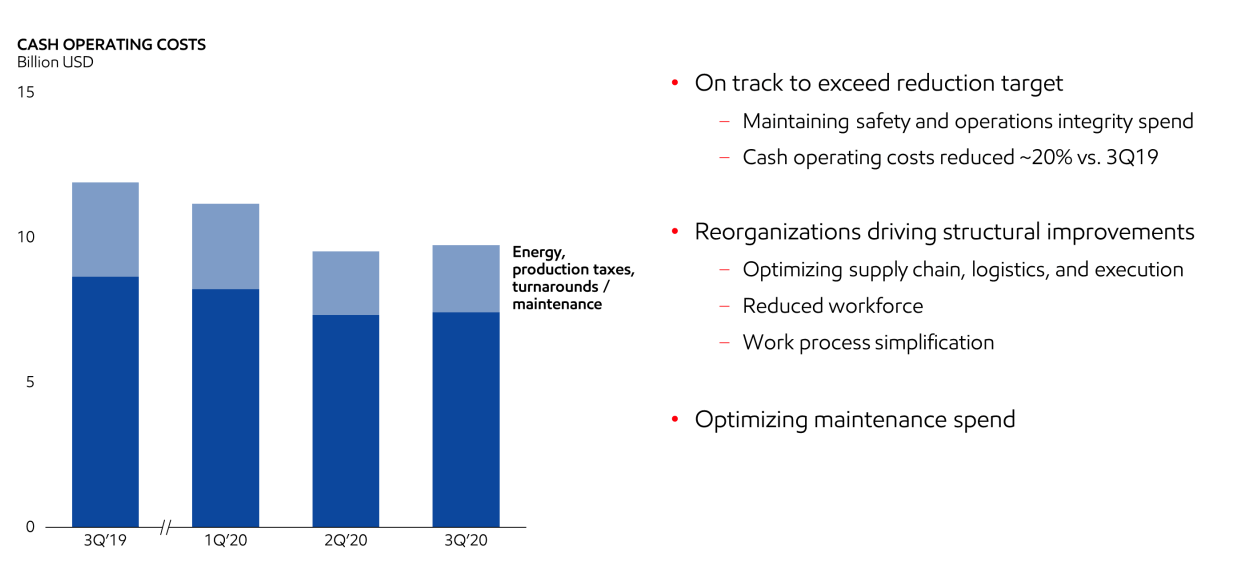

g. FHLB Boston), into the located area of the organizations prominent office largely dictating and therefore financial one can signup. After 2019, just how many insurance company members at the personal banking institutions ranged with various sixteen (FHLB San francisco) so you’re able to 69 (FHLB Des Moines) 3 if you find yourself there were 471 insurance people in brand new FHLB system full, as revealed for the Graph step 1. 2 It portrayed a good 255% rise in registration while the 2008. Insurance companies are seven% of FHLB’s players while you are positions 2nd within their carrying from the new FHLB’s regulating investment inventory within 14.5%. 2 In terms of borrowing regarding FHLB, insurance vendors manufactured simply over 5% off professionals one to lent and you will a disproportionately a whole lot more 17.5% away from full improves from the affiliate type of. dos While insurance companies do not take over subscription because of the numbers, the utilization of the FHLB is better for the a relative foundation into the 2019. On top of that, Graph dos illustrates the elevated utilize, as well as during the Higher Financial crisis.

Resource while the FHLBs

Capital from the FHLB system is protected. Players accessibility money due to head contact with the respective FHLBank and you may need certainly to blog post security discover fund. Eligible security may differ and generally include marketable ties particularly because You.S. Government Ties, Organizations, Home loan Recognized Ties (MBS) in addition to Collateralized Financial Financial obligation (CMOs) and you can Municipals, together with other possessions instance a property fund. Advance limits have decided by making use of an excellent haircut for the collateral published, toward amount of haircut depending on the risk height and you can understood exchangeability of your collateral. On the other hand, the brand new economic position and borrowing from the bank reputation of one’s credit providers is taken into consideration whenever signing up for just like the a part and on an enthusiastic ongoing base.

FHLB banks in Minnesota that offers personal loans online Attractiveness to possess Liquidity Motives

Into introduction of your own COVID-19 wellness drama, which includes contributed to an economic and overall economy, the capacity to supply exchangeability might have been of paramount importance. Recent communications in the Direct of your Council out of FHLBanks to help you certain members of Congress common the FHLBanks continue to function well and that they is actively rewarding its goal and you will getting trustworthy exchangeability at this time, while also detailing the FHLBanks enhanced credit by the forty five% (to people) inside 2008-2009 financial crisis. 4 Indeed, a glance at the level of historical advances indicated that brand new height rose notably into the first stages off 2008 in advance of dropping back off to lessen membership just like the places normalized and you can liquidity demands subsided. Likewise, advances alive and you will P&C companies implemented an equivalent, albeit highest with the commission basis, pattern during this time period also.

Insurance carrier utilization of the FHLBanks has expanded over the last 2 decades. Membership has increased gradually that have people signing up for various affiliate financial institutions while in the the new countrypanies with joined provides gained out-of the means to access liquidity, albeit shielded, within lower rates. So it liquidity will help increase economic independence, especially in times of industry dislocations particularly now. From the 1 / 3 away from NEAM’s clients was indeed people in an excellent FHLBank on season-stop 2019. 5

Secret Takeaways

- The latest FHLB program offers insurance firms a way to obtain lowest-pricing exchangeability

- Insurance providers can use so it exchangeability for many different strategies

- Recently, market dislocations highlight the increased requirement for exchangeability

Endnotes

step one Pick Short Takes, Government Home loan Lender Program ; Quick Takes, Government Financial Lender: Suggested Transform so you’re able to Insurance company Subscription ; and you can NEAM typed brochures, FHLB and you may Insurance providers (2018 and you will 2019) 2 2019 Mutual Monetary Report of one’s Federal Financial Banking companies step three 2019 Individual FHLBank 10-Ks 4 Council to help you lawmakers for the Covid-19: FHLBanks are operating well, help users,’ 5 Federal Mortgage Financial Subscription Study. Federal Casing Fund Service,

There are various requirements in order to borrowing from the bank from the FHLB, rather than all the insurance vendors have a tendency to meet the requirements. A professional insurance provider need to, among other things, become a member by buying stock regarding FHLB, that is not freely transferable and you will vow securities in excess of 100% of your own loan amount. Activity-dependent funding standards from the time of money and additionally pertain. These monetary responsibilities will get impair an insurance coverage company’s capacity to see almost every other personal debt otherwise build almost every other assets. Including, the addition of property instead additional funding could affect good organization’s total financial character.